Schedule 14A

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ | Filed by a party other than the Registrant ¨ | |

| Check the appropriate box: | ||

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| þ | Definitive Proxy Statement – | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |

| NATURAL HEALTH TRENDS CORP. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

NATURAL HEALTH TRENDS CORP.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 10, 201814, 2020

To the Stockholders of Natural Health Trends Corp.:

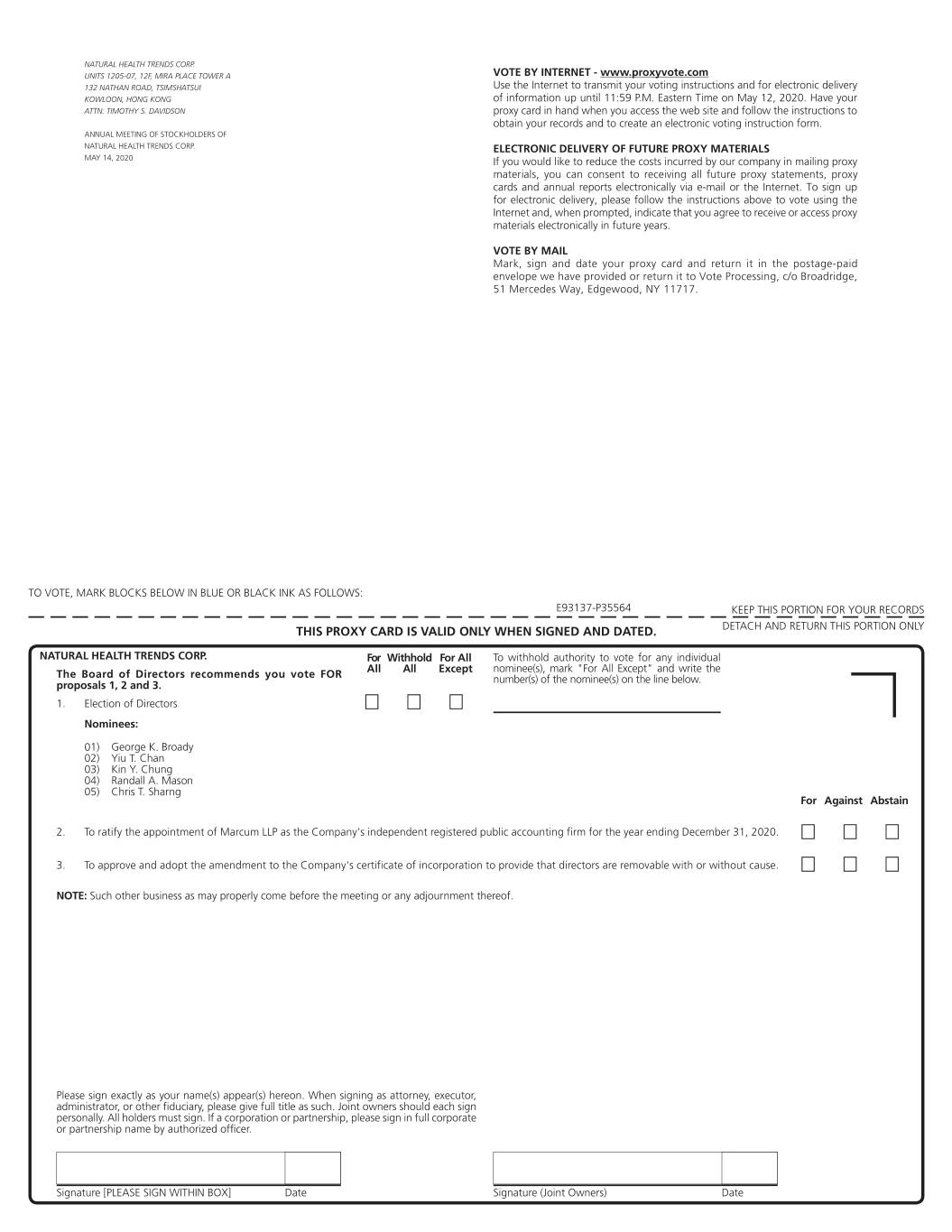

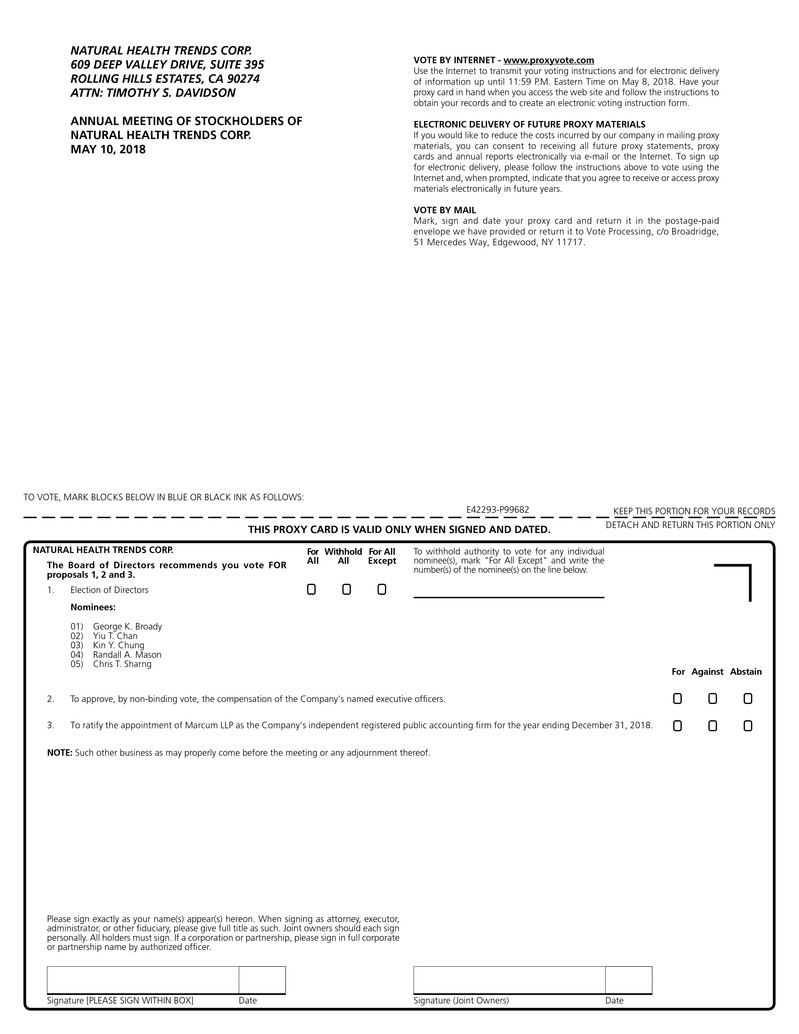

The 20182020 annual meeting of stockholders of Natural Health Trends Corp. (the “Company”) will be held on May 10, 2018,14, 2020, beginning at 9:00 a.m. local time, at Hong Kong Gold Coast Hotel, 1 Castle Peak Road, Gold Coast, Hong Kong.The Ritz-Carlton, Rancho Mirage, 68900 Frank Sinatra Drive, Rancho Mirage, CA 92270. At the meeting, the holders of the Company’s outstanding common stock will act on the following matters:

Election of five (5) directors to the Board of Directors of the Company to serve until the next annual meeting of the Company’s stockholders;

Ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the Company for fiscal year ending December 31, 2018.2020

Approval and adoption of the amendment to the Company’s certificate of incorporation to provide that directors are removable with or without cause

All holders of record of shares of the Company’s common stock at the close of business on March 12, 201818, 2020 are entitled to vote at the meeting and any postponements or adjournments of the meeting.

We are using Securities and Exchange Commission rules that allow the Company to furnish proxy materials on the Internet to stockholders of the Company. Consequently, stockholders will not automatically receive paper copies of our proxy materials. We are instead sending to stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our proxy statement and Annual Report on Form 10-K, and for voting via the Internet. The electronic delivery of our proxy materials will reduce our printing and mailing costs and any environmental impact.

The Notice of Internet Availability of Proxy Materials identifies the date, time and location of the annual meeting; the matters to be acted upon at the meeting and the Board of Directors’ recommendation with regard to each matter; a toll-free telephone number, an e-mail address, and a website where shareholders can request a paper or e-mail copy of our proxy materials, including our Annual Report on Form 10-K, proxy statement and a proxy card, free of charge.

We currently intend to hold our annual meeting in person. However, we are monitoring the coronavirus (COVID-19) outbreak and related precautions, and it may become necessary or advisable to change the date, time, location and/or means of holding the annual meeting (including by means of remote communication). Any such change will be announced via press release and website posting, as well as the filing of additional proxy materials with the Securities and Exchange Commission.

By Order Of The Board Of Directors, | |

| /s/ Timothy S. Davidson | |

Timothy S. Davidson Chief Financial Officer, Senior Vice President and Corporate Secretary | |

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE EXERCISE YOUR VOTING RIGHTS. THISTHE PROXY STATEMENT IS FIRST BEING MADE AVAILABLESENT OR GIVEN TO THE COMPANY’S STOCKHOLDERS ON OR ABOUT MARCH 28, 2018.APRIL 2, 2020.

TABLE OF CONTENTS

| Page | |

| How do I vote? | |

| fail to provide timely directions? | |

| What constitutes a quorum? | |

| What are the Board of Directors’ recommendations? | |

| 2019? | |

| Are Company employees or directors permitted to engage in hedging transactions? | |

| Does the Company have a Code of Ethics? | |

| INFORMATION ABOUT EXECUTIVE OFFICERS | |

| Information | |

| Arrangements | |

| 2019 | |

| Post-Termination Payment Arrangements | |

| Director Compensation | |

| 2020 | |

| ITEM THREE: APPROVAL AND ADOPTION OF THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO PROVIDE THAT DIRECTORS ARE REMOVABLE WITH OR WITHOUT CAUSE | |

| Introduction and Reasons for Amendment | |

| Description of Amendment | |

| Effects of Stockholder Approval of Proposed Amendment | |

| OTHER MATTERS | |

| Stockholder Proposals for the 2021 Annual Meeting of Stockholders | |

| HOUSEHOLDING INFORMATION | |

NATURAL HEALTH TRENDS CORP.

PROXY STATEMENT

This proxy statement contains information related to the annual meeting of stockholders of Natural Health Trends Corp. (“the Company”, “we”, “our” or “us”) to be held on May 10, 201814, 2020 beginning at 9:00 a.m. local time, at Hong Kong Gold Coast Hotel, 1 Castle Peak Road, Gold Coast, Hong Kong,The Ritz-Carlton, Rancho Mirage, 68900 Frank Sinatra Drive, Rancho Mirage, CA 92270, and at any postponements or adjournments thereof. This proxy statement is first being made available to stockholders on or about March 28, 2018.April 2, 2020.

ABOUT THE MEETING

What is the purpose of the meeting?

At the annual meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders included with this proxy statement.

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on March 12, 2018,18, 2020, the record date for the meeting, are entitled to receive notice of and to participate in the annual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the meeting, or any postponements or adjournments of the meeting.

What are the voting rights of the holders of the Company’s common stock?

Each outstanding share of the Company’s common stock will be entitled to one vote on each matter considered at the meeting. Cumulative voting in the election of directors is prohibited by the Company’s certificate of incorporation.

Who can attend the meeting and where is it being held?

All stockholders as of the record date, or their duly appointed proxies, may attend the meeting. The meeting is being held at the location identified above. To obtain directions to attend the meeting in person, please contact the Company at 310-541-0888.+852-3107-0800.

Why did I initially receive a Notice of Internet Availability regarding proxy materials this year instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy materials over the Internet to our stockholders. Accordingly, a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) was or will be sent to many of our stockholders providing notice of the annual meeting and enabling stockholders to access our proxy materials on the website referred to in the Notice of Internet Availability or request to receive free of charge a printed set of the proxy materials, including the Notice of Annual Meeting, our 20172019 Annual Report on Form 10-K, this proxy statement and a proxy card. Instructions on how to access the proxy materials over the Internet or to request a printed copy are set out in the Notice of Internet Availability. Those stockholders that previously requested to receive our proxy materials in printed or electronic form will receive such proxy materials in lieu of the Notice of Internet Availability.

How can I elect the manner in which I will receive proxy materials in the future?

All stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis by following the instructions in the Notice of Internet Availability or proxy materials. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet in order to help reduce printing and mailing costs and any environmental impact.

How do I vote?

| By Mail: | If you |

| In Person: | If you are a registered stockholder and attend the meeting, you may vote in person at the meeting. If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you must obtain a valid legal proxy from your broker, bank or other agent to vote in person at the meeting. |

| Via Internet: | Log on to http://www.proxyvote.com and follow the on-screen instructions. |

How may my broker, bank or other agent vote my shares if I fail to provide timely directions?

Brokers, banks or other agents holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other agent will have discretion to vote your shares on the “routine” matters to be voted upon at the meeting — the proposal to ratify the appointment of Marcum LLP (Item Two) and the proposal to amend the Company’s certificate of incorporation (Item Three). Your broker may not have discretion to vote on the election of directors (Item One) absent direction from you.

Can I change my vote or revoke my proxy?

Yes. You can change your vote or revoke your proxy. If you are a registered stockholder, you may revoke your proxy in any one of four ways.

You may send a written notice that you are revoking your proxy to the Company’sCompany's Corporate Secretary at Natural Health Trends Corp., 609 Deep Valley Drive, Suite 395, Rolling Hills Estates, 90274,the Company’s principal executive offices located at Units 1205-07, 12F, Mira Place Tower A, 132 Nathan Road, Tsimshatsui, Kowloon, Hong Kong, Attention: Timothy S. Davidson.

You may timely grant another proxy via the Internet.

You may submit another properly completed proxy card with a later date.

You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy.

Your most current proxy, whether submitted by proxy card, via the Internet or in person, is the one that is counted.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the aggregate voting power of the stock outstanding on the record date will constitute a quorum, permitting the stockholders to act upon the matters outlined in the Notice of Annual Meeting of Stockholders. As of the record date, 11,422,539 shares of common stock, representing the same number of votes, were outstanding. Thus, the presence of the holders of common stock representing at least 5,711,270 shares of common stock will be required to establish a quorum.

A proxy submitted by a stockholder may indicate that all or a portion of the shares represented by the proxy are not being voted (“stockholder withholding”) with respect to a particular matter. Similarly, a broker may not be permitted to vote stock (“broker non-vote”) held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock. See above under the caption “How may my broker, bank or other agent vote my shares if I fail to provide timely directions?” The shares subject to a proxy that are not being voted on a particular matter because of either stockholder withholding or broker non-vote will count for purposes of determining the presence of a quorum. Abstentions are also counted in the determination of a quorum.

What are the Board of Directors’ recommendations?

Unless you give other instructions on your returned proxy, the persons named as proxy holders on the proxy will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are set forth together with the description of each item in this proxy statement. In summary, the Board of Directors recommends a vote:

for election of the nominated slate of Directors (see Item One);

for ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the Company for fiscal year ending December 31, 20182020 (see Item Two)

for approval and adoption of the amendment to the Company’s certificate of incorporation to provide that directors are removable with or without cause (see Item Three).

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item?

Election of Directors.The affirmative vote of a plurality of the votes cast at the meeting is required for the election of Directors. A properly executed proxy marked “Withhold Authority” with respect to the election of all Directors will not be voted with respect to the Directors, although it will be counted for purposes of determining whether there is a quorum.

Ratification of Independent Registered Public Accounting Firm.For the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the Company for fiscal year ending December 31, 2018,2020 (Item Two), the affirmative vote of a majority of the votes cast by the stockholders present in person or represented by proxy and entitled to vote at the meeting will be required for approval. You may vote “for,” “against” or “abstain” on this proposal. Abstentions and broker non-votes (to the extent applicable) are not considered “votes cast” on this item, and thus will not affect the outcome of the vote for this item.

Approval and Adoption of Amendment to the Company’s Certificate of Incorporation. For the approval and adoption of the amendment to the Company’s certificate of incorporation to provide that directors are removable with or without cause (Item Three), the affirmative vote of the holders of a majoritytwo-thirds (2/3) of the outstanding shares represented in person or by proxy and entitled to vote on the item at the annual meetingof common stock will be required for approval. A properly executed proxy marked “Abstain” will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstentionrequired. You may vote “for,” “against” or “abstain” on this proposal. Abstentions and broker non-votes (to the extent applicable) will have the effect of a negative votevotes for such item.proposal.

What types of expenses will the Company incur?

The expense of preparing, printing and mailing proxy materials and the Notice of Internet Availability, as well as all expenses of soliciting proxies, will be borne by the Company. In addition to the use of the mails, proxies may be solicited by officers and directors and regular employees of the Company, without additional remuneration, by personal interviews,interaction, telephone, telegraph or facsimile transmission. The Company may elect to engage a proxy solicitation firm to solicit stockholders to vote or grant a proxy with respect to the proposals contained in this proxy statement. The Company will request brokers, banks, nominees, custodians, fiduciaries and other agents to forward proxy materials to the beneficial owners of shares of common stock held of record and will provide reimbursements for the cost of forwarding the material in accordance with customary charges.

STOCK OWNERSHIP

Who are the owners of the Company’s stock?

The following table shows the amount of the Company’s common stock beneficially owned (unless otherwise indicated) as of March 12, 201818, 2020 by (i) each stockholder known to us to be the beneficial owner of more than 5% of the Company’s common stock, (ii) each director or director nominee, (iii) each of the Company’s named executive officers and (iv) all executive officers and directors as a group. Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission and generally includes those persons who have voting or investment power with respect to the securities. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of the Company’s common stock beneficially owned by them.

Name and Address of Beneficial Owner (1) | Amount and Nature of Beneficial Ownership (2) | Percent of Class (2) | Amount and Nature of Beneficial Ownership (2) | Percent of Class (2) | ||||||||

| Executive Officers and Directors: | ||||||||||||

| Chris T. Sharng | 478,574 | (3) | 4.2 | % | 886,645 | (3) | 7.8 | % | ||||

| Timothy S. Davidson | 232,642 | (4) | 2.0 | % | 391,100 | (4) | 3.4 | % | ||||

| George K. Broady | 866,423 | (5) | 7.6 | % | 690,099 | (5) | 6.0 | % | ||||

| Yiu T. Chan | — | — | — | — | ||||||||

| Kin Y. Chung | 3,058 | * | 3,058 | * | ||||||||

| Randall A. Mason | 252,733 | (6) | 2.2 | % | 252,733 | (6) | 2.2 | % | ||||

| All executive officers and directors as a group (6 persons) | 1,833,430 | (7) | 16.1 | % | 2,223,635 | (7) | 19.5 | % | ||||

| Stockholders Beneficially Owning 5% or More | ||||||||||||

| Non-Executive Stockholders Beneficially Owning 5% or More | ||||||||||||

| The Jane Eleanor Broady Irrevocable Trust | 2,245,128 | (8) | 19.7 | % | 2,245,128 | (8) | 19.7 | % | ||||

| Renaissance Technologies LLC | 903,600 | (9) | 8.0 | % | 891,017 | (9) | 7.8 | % | ||||

| * | Less than 1% of the Company’s outstanding common stock. | ||

| (1) | Unless otherwise indicated, the address of each beneficial owner is c/o Natural Health Trends Corp., |

| (2) | Any securities not outstanding that are subject to conversion privileges exercisable within 60 days of March |

| (3) | Includes |

| (4) | Includes |

| (5) | All shares of stock are held by the George K. Broady 2012 Irrevocable Trust, of which Mr. Broady is the trustee and a beneficiary. The George K. Broady 2012 Irrevocable Trust |

| (6) | Includes (i) 23,899 shares owned by Marden Rehabilitation Associates, Inc., an entity controlled by Mr. Mason. |

| (7) | Includes |

| (8) | Jane Eleanor Broady, the spouse of George K. Broady, is a beneficiary of The Jane Eleanor Broady 2012 Irrevocable Trust. The Jane Eleanor Broady 2012 Irrevocable Trust |

| (9) | The information regarding the beneficial ownership of Renaissance Technologies LLC (“RTC”) is based on the Schedule 13G filed jointly with Renaissance Technologies Holdings Corporation (“RTHC”) with the |

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulation to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on its review of electronic filings with the copies of such reports furnished toSecurities and Exchange Commission and any written representations received by the Company during the fiscal year ended December 31, 2017 and thereafter,from persons required to make filings under Section 16(a), all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were satisfied.

GOVERNANCE OF THE COMPANY

Who are the current members of the Board of Directors and on which committees do they serve?

The members of the Board of Directors on the date of this proxy statement and the committees of the Board of Directors on which they serve are identified below.

| Director | Age | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||

| George K. Broady | — | — | — | |||||

| Yiu T. Chan | M | C | M | |||||

| Kin Y. Chung | M | M | M | |||||

| Randall A. Mason | C | — | C | |||||

| Chris T. Sharng | — | — | — | |||||

M = Member

C = ChairmanChair

Who is the Chairman of the Board of Directors?

Mr. Mason has served as Chairman of the Board of Directors since March 2006. The Chairman of the Board of Directors organizes the work of the Board of Directors and ensures that the Board of Directors has access to sufficient information to enable the Board of Directors to carry out its functions, including monitoring the Company’s performance and the performance of management. In carrying out this role, the Chairman, among other things, presides over all meetings of the Board of Directors, establishes the annual agenda of the Board of Directors, established the agendas of each meeting in consultation with the President, and oversees the distribution of information to directors.

Which directors are considered independent?

The Board of Directors has adopted the requirements in Nasdaq Marketplace Rule 5605(a)(2) as its standard in determining the “independence” of members of its Board of Directors. The Board of Directors has determined that each of the following individuals who are nominated for election as a director qualifies as an “independent director” under this standard:

Yiu T. Chan

Kin Y. Chung

Randall A. Mason

How often did the Board of Directors meet during fiscal 2017?2019?

The Board of Directors met or acted by unanimous written consent a total of nine14 times during the fiscal year ended December 31, 2017,2019, and each director attended at least seventy-five percent (75%) of these meetings. In addition,As described below, the membersCompany’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each met or acted by unanimous written consent a number of times during the fiscal year ended December 31, 2019. During such fiscal year, a special committee of the Board of Directors conducted regular meetings or conference calls with management, closely monitoring the progresscomprised solely of the Company’s business.independent directors met seven times; this special committee has since been dissolved.

What is the role of the Board of Directors’ Audit, Compensation, and Nominating and Corporate Governance Committees?

Audit Committee. Mr. Mason serves as Chairman of the Audit Committee, and Messrs. Chan and Chung also serve as members of the Audit Committee. The Board of Directors has determined that each of Messrs. Mason, Chan and Chung is independent and satisfies the other criteria set forth in the Nasdaq Marketplace Rules for service on the Audit Committee. The Audit CommitteeBoard of Directors has also determined that each of Messrs. Mason and Chan meets the Securities and Exchange Commission criteria of an “audit committee financial expert” and that each also meets the requirements of Nasdaq Marketplace Rule 5605 relating to financial oversight responsibility. The Audit Committee is required to meet in person or telephonically at least four times a year. The Audit Committee met or acted by unanimous written consent a total of fiveseven times during the fiscal year ended December 31, 2017.2019.

The functions of the Audit Committee are set forth in the Audit Committee Charter as approved by the Board of Directors and as posted on our website at www.naturalhealthtrendscorp.com. In general, these responsibilities include meeting with the internal financial staff of the Company and the independent registered public accounting firm engaged by the Company to review (i) the scope and findings of the annual audit, (ii) quarterly financial statements, (iii) accounting policies and procedures and (iv) the internal controls employed by the Company. The Audit Committee is also directly and solely responsible for the appointment, retention, compensation, oversight and termination of the Company’s independent registered public accounting firm. The Audit Committee’s findings and recommendations are reported to management and the Board of Directors for appropriate action.

Compensation Committee. The Compensation Committee operates pursuant to a charter approved by the Board of Directors, a copy of which is posted on our website at www.naturalhealthtrendscorp.com. The members of our Compensation Committee are Messrs.Yiu T. Chan and Kin Y. Chung, with Mr. Chan serving as Chairman of the Compensation Committee. Each of the members of the Compensation Committee qualifies as an “independent director” within the meaning of the Nasdaq Marketplace Rules. The Compensation Committee is charged with responsibility to oversee our compensation policies and programs, including developing compensation, providing oversight of the implementation of the policies, and specifically addressing the compensation of our executive officers and directors, including the negotiation of employment agreements with executive officers. The Compensation Committee is not authorized to delegate to another body or person any of its responsibilities (other than to a subcommittee of the Compensation Committee), although it may seek compensation-related input from the Company’s management, other directors, consultants and other third parties. The Compensation Committee considers all elements of executive compensation together and utilizes the members’ experience and judgment in determining the total compensation opportunity and mix of compensation elements appropriate for each executive officer in light of the Company’s compensation objectives. The Compensation Committee periodically consults with our President, who makes recommendations to the Compensation Committee regarding compensation of our key employees, including that of theour executive officers. Our President makes recommendations to the Compensation Committee regarding base salaries, and may recommend that the incentive compensation otherwise payable to an employee under the Company’s Sales Incentive Plan, Annual Incentive Plan or 2014 Long-Term Incentive Plan (as further described in this proxy statement) be increased or decreased. Notwithstanding the President’s participation in some of the Compensation Committee’s deliberations,activities, all compensation determinations are made by the Compensation Committee. The Compensation Committee also annually evaluates compensation to be awarded to each of its non-employee directors, with a focus on monthly cash retainer payment arrangements, as well as whether annual performance justifies the award of discretionary cash or equity bonuses. Additional information with respect to the Compensation Committee and its processes and procedures may be found below under the caption “Compensation of Named Executive Officers and Directors.” The Compensation Committee met or acted by unanimous written consent a total of fourseven times during the fiscal year ended December 31, 2017.2019.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee (the “Nominating Committee”) operates pursuant to a charter approved by our Board of Directors, a copy of which is posted on our website at www.naturalhealthtrendscorp.com. The members of the Nominating Committee are Messrs.Randall A. Mason, Yiu T. Chan and Kin Y. Chung, with Mr. Mason serving as Chairman of the Nominating Committee. Each of the members of the Nominating Committee qualifies as an “independent director” within the meaning of the Nasdaq Marketplace Rules. The Nominating Committee considers and makes recommendations to the Board of Directors with respect to the size and composition of the Board of Directors and identifies potential candidates to serve as directors. The Nominating Committee identifies candidates to the Board of Directors by introduction from management, members of the Board of Directors, employees or other sources and stockholders that satisfy the Company’s policy and Bylaw provisions regarding stockholder recommended candidates. The Nominating Committee does not evaluate director candidates recommended by stockholders differently than director candidates recommended by other sources. The Nominating Committee met or acted by unanimous written consent one time during the fiscal year ended December 31, 2017.2019.

A stockholder wishing to nominate an individual for election to the Board of Directors or to otherwise submit a candidate for consideration by the Nominating Committee must comply with the advance notice provisions set forth in our Bylaws, which are generally described in this proxy statement under the caption “Additional Information - Information—Stockholder Proposals for the 20192021 Annual Meeting of Stockholders.” These provisions require the timely submission of information concerning the nominee or candidate, as well as information as to the stockholder’s ownership of our common stock.

In considering Board of Director candidates, the Nominating Committee takes into consideration the Company’s “New Director Candidates” factors (as set forth in the charter of the Nominating Committee), the Company’s policy regarding stockholder-recommended director candidates as set forth above, selection criteria recommended by stockholders, and all other factors that they deem appropriate, including, but not limited to, the individual’s judgment, skill, diversity, integrity, and experience. In evaluating a candidate’sexperience with businesses and other organizations of comparable size, industry knowledge, the interplay of the candidates experience with the experience of the existing members of the Board of Directors, the number of other public and private company boards on which the candidate serves and diversity, the Nominating Committee considers the candidate’sof age, gender, ethnicity, and such other factors as it deems appropriate given the current needs of the Board of Directors and the Company to maintain a balance of knowledge, experience, background, and capability. At this time, the Nominating Committee does not have a specific process for assessing the effectiveness of its consideration of diversity in director candidates, but believes that the diversity reflected in the composition of its Board of Directors is appropriate given the nature of the Company’s business. For each new or vacant position on the Board of Directors, the charter of the Nominating Committee provides that the Nominating Committee shall ensure that a diverse slate of candidates is identified and evaluated. In evaluating whether an incumbent director should be nominated for re-election to the Board of Directors, the Nominating Committee takes into consideration the same factors established for other director candidates and also takes into account the incumbent director’s performance as a member of the Board of Directors.

To date, the Nominating Committee has not received a candidate recommendation from any stockholder (or group of stockholders) that beneficially owns more than five percent of the Company’s common stock.

What is the Board of Directors’ role in risk oversight?

Our Board of Directors has responsibility for the oversight of risks that could affect the Company. This oversight is conducted primarily through the Board of Directors with respect to significant matters, including the strategic direction of the Company, and by the various committees of the Board of Directors in accordance with their charters. The Board of Directors continually works, with the input of its committees and of the Company’s management to assess and analyze the most likely areas of future risk for the Company. Directors also have complete and open access to all of our employees and are free to, and do, communicate directly with our management. In addition to our formal compliance efforts, the Board of Directors encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations.

How are directors compensated?

Our employee director did not receive compensation for his service as director. Information with respect to the compensation of the non-employee members of our Board of Directors is set forth below under the caption “Compensation of Named Executive Officers and Directors—Director Compensation.”

How do stockholders communicate with the Board of Directors?

Stockholders or other interested parties wishing to communicate with the Board of Directors, the independent directors as a group, or any individual director may do so in writing by sending an e-mail to compliance@nhtglobal.com, or by mail to Natural Health Trends Corp. at the address of its headquarters (609 Deep Valley Drive, Suite 395, Rolling Hills Estates, California 90274,(Units 1205-07, 12F, Mira Place Tower A, 132 Nathan Road, Tsimshatsui, Kowloon, Hong Kong, Attention: Timothy S. Davidson). Complaints or concerns that appear to involve Mr. Davidson may be directed to the Chairman of the Audit Committee at audit.chair@nhtglobal.com; alternatively, any such complaints or concerns may be submitted anonymously at www.lighthouse-services.com/nhtglobal.audit.chair@nhtglobal.com. Complaints or concerns relating to the Company’s accounting, internal accounting controls or auditing matters, and concerns regarding questionable accounting or auditing matters are referred to the Chairman of the Audit Committee. Alternatively, any such complaints or concerns may be submitted anonymously at www.lighthouse-services.com/nhtglobal. Other Board communications are referred to the Chairman of the Board of Directors, provided that advertisements, solicitations for periodical or other subscriptions, and similar communications generally are not forwarded. The Company held an annual stockholders meeting on May 4, 2017,June 19, 2019, and the Company does not, at this time, have a policy regarding director attendance at annual stockholder meetings.

Are Company employees or directors permitted to engage in hedging transactions?

No. The Company’s Insider Trading Policy prohibits employees and directors from entering into hedging transactions or similar arrangements with respect to the Company’s stock.

Does the Company have a Code of Ethics?

The Company has a Worldwide Code of Business Conduct (the “Code”) that applies to itsour employees, officers (including our principal executive officer and principal financial officer) and directors, which is posted on the Company’s website at www.naturalhealthtrendscorp.com.directors. The Code is intended to establish standards necessary to deter wrongdoing and to promote compliance with applicable governmental laws, rules and regulations, and honest and ethical conduct. The Code covers many areas of professional conduct, including conflicts of interest, financial reporting and disclosure, protection of Company assets and confidentiality. Employees have an obligation to promptly report any known or suspected violation of the Code without fear of retaliation. The Company has made the Code available on its website at https://ir.naturalhealthtrendscorp.com/governance-docs. Waiver of any provision of the Code for executive officers and directors may only be granted by the Board of Directors and any such waiver or any modification of the Code relating to such individuals will be disclosed by the Company on its website at www.naturalhealthtrendscorp.com.https://ir.naturalhealthtrendscorp.com.

Certain Relationships and Related Transactions—What related party transactions requiring disclosure involved directors, executive officers or significant stockholders?

In February 2013, the Company entered into a Royalty Agreement and License with BHS regardingfor the manufacture and sale of a product called ReStor™.ReStor™ with Broady Health Sciences, L.L.C. (“BHS”), a company owned by George K. Broady (a director of the Company). Under this agreement (as amended), the Company agreed to paypays BHS a price per unit royalty of 2.5% of sales revenue in return for the right to manufacture (or have manufactured), market, import, export and sell this product worldwide with certain rights being exclusive outside the United States. On April 29, 2015, the Company and BHS amended the Royalty Agreement and License to change the royalty to a price per unit instead of 2.5% of sales revenue. This provision was effective retroactive to January 1, 2015.by or through multi-level marketing or network marketing. The Company recognized royalties of $475,000 payable to BHS$96,000 and $327,000 during 2019 and 2018, respectively, under this agreement during 2017.agreement. The Company is not required to purchase any product under the agreement, and the agreement may be terminated at any time on 120 days’ notice or, under certain circumstances with no notice. OtherwiseAn amendment to the agreement terminateson March 20, 2020 extends the term for an additional five years to March 31, 2020.2025, after which it shall be automatically renewed for successive one-year terms unless notice is given at least 90 days in advance of the expiration of the then-current term.

On May 17, 2019, the Company entered into a Stock Repurchase Agreement with The George K. Broady 2012 Irrevocable Trust (“Broady Trust”). Mr. Broady is the trustee and a beneficiary of the Broady Trust. The Stock Repurchase Agreement, which the Company and the Broady Trust entered into in accordance with Rule 10b5-1 under the Securities Exchange Act of 1934, provided for the Company’s purchase of common stock from the Broady Trust in off-the-market, private transactions at a rate of 0.4105 times the number of shares purchased by the Company’s broker in the open market as part of a stock repurchase program authorized by the Company’s Board of Directors on May 16, 2019. The Company’s purchases from the Broady Trust concluded on May 31, 2019, were completed at a per share purchase price equal to the weighted average price per share paid by the Company’s broker in its open-market purchases, and resulted in the purchase of 178,324 shares of common stock for an aggregate purchase price of $1.9 million.

INFORMATION ABOUT EXECUTIVE OFFICERS

Certain information concerning executive officers of the Company is set forth below:

| Name | Age | Position(s) with the Company | ||

| Chris T. Sharng | President | |||

| Timothy S. Davidson | Chief Financial Officer, Senior Vice President and Corporate Secretary | |||

Chris T. Sharng. Mr. Sharng has served as President of the Company since February 2007, and as a director since March 2012. He served as Executive Vice President and Chief Financial Officer of the Company from August 2004 to February 2007. Mr. Sharng also performed the functions of the principal executive officer of the Company from April 2006 to August 2006. From March 2006 to August 2006, Mr. Sharng served as a member of the Company’s Executive Management Committee, which was charged with managing the Company’s day-to-day operations while a search was conducted for a new chief executive officer for the Company. From March 2004 through July 2004, Mr. Sharng was the Chief Financial Officer of NorthPole Limited, a privately held Hong Kong-based manufacturer and distributor of outdoor recreational equipment. From October 2000 through February 2004, Mr. Sharng was the Senior Vice President and Chief Financial Officer of Ultrak Inc., which changed its name to American Building Control Inc. in 2002, a Texas-based, publicly traded company listed on The NASDAQ Stock Market that designed and manufactured security systems and products. From March 1989 through July 2000, Mr. Sharng worked at Mattel, Inc., most recently as the Vice President of International Finance. Mr. Sharng has an MBA from Columbia University and received his bachelor degree from National Taiwan University.

Timothy S. Davidson. Mr. Davidson has served as the Company’s Chief Financial Officer and Senior Vice President since February 2007, and as the Company’s Corporate Secretary since January 2014. He previously served as the Company’s Chief Accounting Officer from September 2004 to February 2007. From March 2001 to September 2004, Mr. Davidson was Corporate Controller for a telecommunications company, Celion Networks, Inc., located in Richardson, Texas. From February 2000 to February 2001, Mr. Davidson was Manager of Financial Reporting for another Dallas-based telecommunications company, IP Communications, Inc. From December 1994 through January 2000, Mr. Davidson was employed by Arthur Andersen, LLP, most recently as an Audit Manager. Mr. Davidson has a master degree in professional accounting from the University of Texas at Austin and received his bachelor degree from Texas A&M University at Commerce.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates this Report of the Audit Committee by reference therein.

We have reviewed and discussed the consolidated financial statements of the Company set forth at Item 8 in the Company’s Annual Report on Form 10-K for the year ended December 31, 20172019 with management of the Company and Marcum LLP (“Marcum”).

We have discussed with Marcum the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 61, “Communications with Audit Committees.”and the Securities and Exchange Commission.

We have received the written disclosures and the letter from Marcum required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and have also discussed with Marcum that firm’s independence. The Audit Committee has concluded that Marcum’s services provided to the Company are compatible with Marcum’s independence.

Based on our review and discussions with management of the Company and Marcum referred to above, we recommended to the Board of Directors that the consolidated financial statements of the Company be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.2019.

It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s consolidated financial statements are complete and accurate and in accordance with accounting principles generally accepted in the United States of America; that is the responsibility of management and the Company’s independent registered public accounting firm. In giving its recommendation to the Board of Directors, the Audit Committee has relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and (ii) the reports of the Company’s independent registered public accounting firm with respect to such financial statements.

Members of the Audit Committee of the Board of Directors

Randall A. Mason (Chairman)

Yiu T. Chan

Kin Y. Chung

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information regarding all compensation plans under which the Company’sCompany's equity securities were authorized for issuance as of December 31, 2017:2019:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||

| Equity compensation plans approved by security holders | — | $ | — | |||||||

| Equity compensation plans not approved by security holders | — | $ | — | — | ||||||

| Total | — | $ | — | |||||||

The foregoing securities remaining available for issuance were reserved under the Company’sCompany's 2016 Equity Incentive Plan.

COMPENSATION OF NAMED EXECUTIVE OFFICERS AND DIRECTORS

Summary Named Executive Officer Compensation Discussion and AnalysisInformation

The following discussiontable provides information concerning the compensation for the years ended December 31, 2019 and analysis describes2018 of our principal executive officer and one other executive officer (collectively, the Company’s compensation objectives and policies and each element of compensation awarded to the Company’s executive officers (its “named executive officers”) during 2017, who are::

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||

| Chris T. Sharng, President | 2019 | 1,000,000 | — | 393,444 | (3) | 1,393,444 | ||||||||

| 2018 | 1,000,000 | 125,000 | (1) | 414,801 | (4) | 1,539,801 | ||||||||

| Timothy S. Davidson, Chief Financial Officer, Senior Vice President and Corporate Secretary | 2019 | 350,000 | — | 170,863 | (5) | 520,863 | ||||||||

| 2018 | 350,000 | 200,000 | (2) | 165,424 | (6) | 715,424 | ||||||||

_______________________

| (1) | Represents the amount earned under the Company's Annual Incentive Plan (the “Annual Plan”). No amount was earned under the Company's 2014 Long-Term Incentive Plan (the “Long-Term Plan”). See Named Executive Officer Compensation Arrangements below for information regarding payment terms specific to each plan. |

| (2) | Represents $125,000 earned under the Long-Term Plan and $75,000 earned under the Annual Plan. Of the amount earned under the Long-Term Plan, $93,750 was awarded in the form of cash and $31,250 was awarded in the form of shares of restricted stock. See Named Executive Officer Compensation Arrangements below for information regarding payment terms specific to each plan. |

| (3) | Represents $12,600 in employer matching contributions under the Company’s defined contribution plan and $380,844 in tax gross-up payments. |

| (4) | Represents $12,375 in employer matching contributions under the Company’s defined contribution plan and $402,426 in tax gross-up payments. |

| (5) | Represents $12,600 in employer matching contributions under the Company’s defined contribution plan and $158,263 in tax gross-up payments. |

| (6) | Represents $12,375 in employer matching contributions under the Company’s defined contribution plan and $153,049 in tax gross-up payments. |

Named Executive Officer Compensation Arrangements

Chris T. Sharng. The Company is a party to an employment agreement with Mr. Sharng - President

| Net Sales Performance Goal | Adjusted EBITDA Performance Goal | |||||||||||||

| Name | Base Salary Points Percentage | Performance Goal Weighting | Ratio of Actual to Target | Performance Goal Weighting | Ratio of Actual to Target | Participant Cash Award | ||||||||

| Chris T. Sharng | 32% | 75% | 60% | 25% | 60% | $ | — | |||||||

| Timothy S. Davidson | 6% | 60% | 60% | 40% | 60% | 150,000 | ||||||||

Neither Mr. Sharng nor any other Company employee was designated by the Compensation Committee to participate in the Long-Term Plan in 2019. However, he did participate in the Long-Term Plan in 2018 and was eligible for an incentive compensation award paymentto earn awards under the Annual Plan, an employee must remain in a continuous employment or other service provider relationship with the Company through both the conclusion of the annual performance period to which the award relates and through the date on which each incentive payment is actually made over the course of the Distribution Year.

| Name | Base Salary Points Percentage | Ratio of Actual to Target Performance Goal | Participant Cash Award | Participant Stock Award(1) | ||||||||

| Chris T. Sharng | 63% | 60% | $ | 187,500 | $ | 62,500 | ||||||

| Timothy S. Davidson | 12% | 60% | 187,500 | 62,500 | ||||||||

Notwithstanding the foregoing generally applicable terms of the Long-Term Plan, on August 9, 2019 (the “2019 Amendment Date”) the Compensation Committee amended the Long-Term Plan (the “2019 Amendment”) to provide that all unpaid cash benefits earned by then-employed participants under the Long-Term Plan with respect to performance periods that concluded on or prior to December 31, 2018 shall be paid on the 2019 Amendment Date in a continuous employment or other service provider relationshipthe form of the award of shares of restricted stock, with the Company throughoutnumber of shares issued being determined based upon the conclusionmarket price of the yearCompany’s common stock on the 2019 Amendment Date. The restricted stock awards were issued under the Company’s 2016 Equity Incentive Plan pursuant to an authorized form of restricted stock award agreement, which provides for vesting in whichquarterly increments over three years following the award was earned and through2019 Amendment Date, subject to the date on which eachparticipant’s continued employment with the Company. Pursuant to the terms of the 2019 Amendment, Mr. Sharng received 408,071 shares of restricted stock for unpaid cash incentive payment is actually made, orbenefits under the Long-Term Plan of $2.9 million. Inasmuch as the shares of restricted stock vest. The Company believes that the extended pay-out and continuous service arrangements of the Long-Term Plan align the interests of participantsissued to Mr. Sharng in connection with the long-term interests of the Company’s stockholders.

In 2019 and 2018, Mr. Sharng also received certain gross-up payments for taxes payable in the sole discretion ofconnection with restricted stock grants made to him; however, the Compensation Committee each of the named executive officers may be paidhas since determined as a taxgeneral policy not to make gross-up payment designed to cover allpayments for income and employment taxes resulting fromin the awardfuture, with respect to either past or future compensatory awards. Mr. Sharng serves on the Company’s Board of such restricted stock.Directors, but does not receive any additional compensation for his service in that capacity.

Timothy S. Davidson. The tax gross-up payment would be calculatedCompany is a party to an employment agreement with Mr. Davidson that provides for a base annual salary and also entitles Mr. Davidson to participate in our incentive plans (including our equity incentive plan) and other standard U.S. employee benefit programs. Mr. Davidson’s base annual salary was raised to $350,000 effective January 1, 2016. While neither Mr. Davidson nor any other Company employee was designated by the Compensation Committee to participate in the Annual Plan in 2019, Mr. Davidson did participate in the Annual Plan in 2018. In 2018, Mr. Davidson was eligible to receive awards under the Annual Plan based on applicable federal, statethe extent to which the Company achieved Net Sales and local income taxes payable“Adjusted EBITDA” performance goals set by the Compensation Committee at the highest marginal ratesoutset of the year, along with several key metrics established by the Compensation Committee that specifically applied to Mr. Davidson. The individual metrics included the amount of Mr. Davidson’s annual salary compared to that of other participants in the Annual Plan, as well as “performance goal weightings” that were designed to incentivize Mr. Davidson to achieve each performance goal to varying degrees. For example, in 2018 the Compensation Committee established for Mr. Davidson a performance goal weighting of 60% for achievement of the Net Sales performance goal and 40% for achievement of the Adjusted EBITDA performance goal, as it sought to place relatively greater emphasis on incentivizing Mr. Davidson to achieve the Adjusted EBITDA performance goal (as compared to Mr. Sharng’s performance goal weightings of 75% for achievement of the Net Sales performance goal and 25% for achievement of the Adjusted EBITDA performance goal). The Company achieved 80% of the Net Sales performance goal and 68% of the Adjusted EBITDA performance goal in 2018. Accordingly, and after determining in its discretion to reduce the amount otherwise payable to Mr. Davidson under the Annual Plan, the Compensation Committee awarded Mr. Davidson $75,000 in 2018. Awards under the Annual Plan are paid in the year infollowing the conclusion of the annual performance period to which the tax gross-up payment is made. The Compensation Committee determined to make tax gross-up payments toaward relates (the “Distribution Year”), with one-third of the named executive officerstotal award payable in 2017 and in prior years because it believes it is appropriate to avoid dilutinga single lump sum no later than the desired alignmentlast day of interests between such executivesFebruary of the Distribution Year, and the remainder paid in equal installments over the remainder of the Distribution Year in accordance with the Company’s stockholders associated with restricted stock awards.applicable local payroll practices.

Notwithstanding the foregoing generally applicable terms of the Long-Term Plan and conditionsas described above, on the 2019 Amendment Date the Compensation Committee amended the Long-Term Plan pursuant to the terms of the 2019 Amendment. The 2019 Amendment provides that all unpaid cash benefits earned by then-employed participants under the Long-Term Plan with respect to performance periods that concluded on or prior to December 31, 2018 shall be paid on the 2019 Amendment Date in the form of the award of shares of restricted stock, with the number of shares issued being determined based upon the market price of the Company’s common stock on the 2019 Amendment Date. The restricted stock awards were issued under the Company’s 2016 Equity Incentive Plan pursuant to an authorized form of restricted stock award agreement, which provides for vesting in quarterly increments over three years following the 2019 Amendment Date, subject to the participant’s continued employment with the Company. Pursuant to the terms of the 2019 Amendment, Mr. Davidson received 156,583 shares of restricted stock for unpaid cash benefits under the Long-Term Plan of $1.1 million. Inasmuch as the Company’s other full-time salaried employees. Theseshares of restricted stock issued to Mr. Davidson in connection with the 2019 Amendment related to unpaid cash benefits include medical, dental and vision benefits, short-term and long-term disability insurance, accidental death and dismemberment insurance, and basic life insurance coverage.already earned by him in prior years under the Long-Term Plan, the above “Summary Compensation Table” does not reflect any compensation associated with the 2019 Amendment. The Company believes that these benefits are generally consistent with thoseterms of the companies2019 Amendment do not apply to cash or other benefits earned by participants under the Long-Term Plan with which it competes.respect to the performance period for the year ended December 31, 2019 or any later year.

Outstanding Equity Awards at December 31, 2019

The following table provides information concerning outstanding equity awards to our named executive officers are entitledthat remained subject to certain payments or benefits in the event of their termination of employment in some situations or in the event the Company is the subject of a change in control transaction.vesting at December 31, 2019.

| Name | Number of Shares of Stock That Have Not Vested (1) | Market Value of Shares of Stock That Have Not Vested(2) | |||||

| Chris T. Sharng | 341,343 | $ | 1,836,425 | ||||

| Timothy S. Davidson | 133,020 | $ | 715,648 | ||||

_______________________

| (1 | ) | Shares of restricted stock granted to the named executive officers vest on a quarterly basis over the three-year period following the date of grant (extending from March 15, 2019 to December 15, 2020) and are subject to forfeiture in the event of the executive’s termination of service to the Company under specified circumstances. |

| (2 | ) | Amounts in this column are determined by multiplying the number of unvested shares of restricted stock by the closing price per share of the Company’s common stock on December 31, 2019, as reported on the NASDAQ Capital Market. |

Severance and Post-Termination Payment Arrangements

A primary feature of the Company’s employment agreements with its named executive officers provides compensation to the named executive officer in the event of the termination of the executive’s employment under certain circumstances. The employment agreements provide that if the executive’s employment with the Company is terminated voluntarily by him for “good reason,” or is terminated by the Company without “cause,” other than in connection with a “change of control,” then the executive will be entitled to the continuation of the payment of his salary, plus health and medical insurance coverage, for a period of up to one year following the termination date, or until the earlier date upon which he becomes engaged in any “competitive activity” (as defined in a separate non-competition agreement) or otherwise breaches the terms and conditions of such agreement. These severance provisions are intended to compensate the executive until he is able to secure another source of income. In the event the executive’s employment with the Company is terminated by the Company, or its successor in a change of control transaction, without “cause” during the period commencing on the date that is 30 days prior to a change of control through and including a date that is 18 months following the change of control, he is entitled to a payment equal to two years of his salary (plus health and medical insurance coverage costs). This payment is due in a lump sum 30 days after the termination date. These change of control features in the employment agreements are referred to as “double trigger” severance arrangements. This means that no severance compensation will become payable to a named executive officer only because of the occurrence of a change of control of the Company. Instead change of control severance compensation will only be payable if, within 30 days prior to a change of control through and including a date that is 18 months following the change of control, there is also a termination of the executive’s employment without “cause.” These change of control severance provisions are intended to (i) preserve morale and productivity and encourage retention of the executive in the face of the disruptive impact that a change of control of the Company is likely to have, and (ii) encourage the executive to remain focused on the business and interests of the Company’s stockholders when considering strategic alternatives that may be beneficial to those stockholders.

The named executive officers also participate in the Annual Plan and Long-Term Plan in some years (collectively, the “Incentive Plans”). Under the terms of the Incentive Plans, if a participant separates from service for any reason other than on account of a “Qualifying Termination Event,” any award granted to the participant that remains undistributed shall be immediately and irrevocably forfeited in full. A “Qualifying Termination Event” is defined under the Incentive Plans to include a participant’s separation from service from the Company on account of death, due to disability, involuntarily for a reason other than for cause, voluntarily for good reason, due to retirement, or upon a change in control termination. If a participant experiences a separation from service with the Company due to a Qualifying Termination Event and the performance goals relating to an award for a prior performance period have been satisfied but the proceeds of such award remained undistributed, then the Company must pay such undistributed proceeds to the participant in a single lump sum, net of applicable withholding and other taxes, within two and one-half months following the participant’s separation from service and as soon as administratively practicable. These provisions in the Incentive Plans are designed to provide the named executive officers and other participants in such plans with a greater degree of certainty that if the performance goals under an Incentive Plan are achieved, then the participants will ultimately receive the entire amount of incentive compensation earned under the Incentive Plan notwithstanding the occurrence of largely unforeseeable events over which the participants may have little or no control. Similarly, the restricted stock agreements to which the named executive officers are parties provide for the acceleration of vesting of the restricted stock in the event of the executive’s death or disability, or in the event the Company experiences a change in control. In such event, as previously described, the Company may elect to pay the named executive officer income tax gross-up payments designed to cover all income and employment taxes associated with the accelerated vesting of the restricted stock. Finally, the Incentive Plans also provide that if, in connection with a change in control, an excise tax under Section 4999 of the Internal Revenue Code would be imposed upon a participant in connection with an award under an Incentive Plan, then the Company shall pay to the participant an additional amount (the “Excise Gross-Up Payment”) such that the net amount retained by the participant, after deduction of any excise tax and any federal, state or local income tax and any excise tax upon the Excise Gross-Up Payment, shall be equal to the amount that would have been distributable under the Incentive Plan as described above but for the application of Section 4999 of the Internal Revenue Code.

The accounting and tax treatment of particular forms of compensation do not materially affect the Company’s compensation decisions. However, the Company evaluates the effect of such accounting and tax treatment on an ongoing basis and makes appropriate adjustments to compensation policies where appropriate. The Company’s decision to make tax gross-up payments in connection with the awardnamed executives officers currently hold shares of restricted stock to named executive officers is an example of such an adjustment.

| Name and Principal Position | Year | Salary ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||||

| Chris T. Sharng, President | 2017 | $ | 1,000,000 | $ | 250,000 | (1) | $ | 460,772 | (7) | $ | 1,710,772 | |||||||

| 2016 | 993,846 | 2,400,000 | (2) | 278,283 | (8) | 3,672,129 | ||||||||||||

| 2015 | 571,923 | 5,641,053 | (3) | 763,689 | (9) | 6,976,665 | ||||||||||||

| Timothy S. Davidson, Chief Financial Officer, Senior Vice President and Corporate Secretary | 2017 | 350,000 | 400,000 | (4) | 160,054 | (10) | 910,054 | |||||||||||

| 2016 | 349,600 | 1,050,000 | (5) | 89,153 | (11) | 1,488,753 | ||||||||||||

| 2015 | 308,423 | 1,666,041 | (6) | 265,380 | (12) | 2,239,844 | ||||||||||||

| Estimated Possible Payouts Under Non-Equity Incentive Plan Awards | ||||||||||||

| Name | Grant Date | Plan | Threshold ($) | Target ($) | Maximum ($) | |||||||

| Chris T. Sharng | 1/24/2017 | Annual Plan | — | $ | 2,096,078 | (1) | — | |||||

| 1/24/2017 | Long-Term Plan | — | 5,322,305 | (2) | — | |||||||

| Timothy S. Davidson | 1/24/2017 | Annual Plan | — | 412,665 | (1) | — | ||||||

| 1/24/2017 | Long-Term Plan | — | 1,047,829 | (2) | — | |||||||

| Name | Number of Shares Acquired on Vesting (1) | Value Realized on Vesting (2) | |||||

| Chris T. Sharng | 24,628 | $ | 583,039 | ||||

| Timothy S. Davidson | 7,873 | 186,444 | |||||

| Name | Number of Shares of Stock That Have Not Vested (1) | Market Value of Shares of Stock That Have Not Vested (2) | |||||

| Chris T. Sharng | 23,118 | $ | 351,162 | ||||

| Timothy S. Davidson | 7,921 | 120,320 | |||||

| Name | Death | Disability | Involuntary Termination | Retirement | Change of Control | |||||||||||||||

| Chris T. Sharng | ||||||||||||||||||||

| Employment Agreement | $ | — | $ | — | $ | 1,031,038 | $ | — | $ | 2,062,077 | ||||||||||

Annual Plan (1) | — | — | — | — | — | |||||||||||||||

Long-Term Plan (2) | 3,636,651 | 3,636,651 | 3,636,651 | 3,636,651 | 3,636,651 | |||||||||||||||

Restricted Stock (3) | 351,162 | 351,162 | — | — | 351,162 | |||||||||||||||

Income Tax Gross-Up (4) | 433,558 | 433,558 | — | — | 433,558 | |||||||||||||||

Excise Tax Gross-Up (5) | — | — | — | — | 669,403 | |||||||||||||||

| Timothy S. Davidson | ||||||||||||||||||||

| Employment Agreement | — | — | 371,107 | — | 742,214 | |||||||||||||||

Annual Plan (1) | — | — | — | — | — | |||||||||||||||

Long-Term Plan (2) | 1,178,630 | 1,178,630 | 1,178,630 | 1,178,630 | 1,178,630 | |||||||||||||||

Restricted Stock (3) | 120,320 | 120,320 | — | — | 120,320 | |||||||||||||||

Income Tax Gross-Up (4) | 148,552 | 148,552 | — | — | 148,552 | |||||||||||||||

Excise Tax Gross-Up (5) | — | — | — | — | 198,928 | |||||||||||||||

Director Compensation

The following table shows the compensation earned by each non-employee member of the Company’s Board of Directors for 2017:2019:

Director Compensation

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | All Other Compensation ($) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||

| George K. Broady | $ | 200,000 | — | — | $ | 200,000 | $ | 100,000 | $ | — | $ | — | $ | 100,000 | ||||||||||||||

| Yiu T. Chan | 200,000 | — | — | 200,000 | 102,500 | — | — | 102,500 | ||||||||||||||||||||

| Kin Y. Chung | 200,000 | — | — | 200,000 | 102,500 | — | — | 102,500 | ||||||||||||||||||||

| Randall A. Mason | 248,000 | — | — | 248,000 | 150,500 | — | — | 150,500 | ||||||||||||||||||||

_______________________

During 20172019 each non-employee member of our Board of Directors earned a cash retainer of $8,333 per month, plus the reimbursement of their respective out-of-pocket expenses incurred in connection with the performance of their duties as directors. Mr. Mason earned an additional retainer of $4,000 per month as Chairman of the Board of Directors in 2017. Finally,2019. Each of Messrs. Mason, Broady, Chan and Chung receivedearned an additional cash paymentfee of $100,000 in February 2018$2,500 for their services during 2017.service in 2019 on a special committee of the Board of Directors.

ITEM ONE

ELECTION OF DIRECTORS

Under the Company’s Bylaws,bylaws, the number of directors shall not be less than three nor more than eleven, with the exact number fixed from time to time by action of the stockholders or of the Board of Directors.

The Company’s Board of Directors presently consists of five directors whose terms expire at the annual meeting of stockholders. The Nominating Committee recommended, and the Board of Directors has nominated, the five directors identified below.

Biographical summaries of the five persons who have been nominated to stand for election at the annual meeting are provided below for your information. The Board of Directors recommends that these persons be elected at the annual meeting to serve until the next annual meeting of stockholders. Proxies will be voted for the election of the five nominees listed below as directors of the Company unless otherwise specified on the proxy. A plurality of the votes cast by holders of common stock present in person or represented by proxy at the annual meeting will be necessary to elect the directors listed below. If, for any reason, any of the nominees shall be unable or unwilling to serve, the proxies will be voted for a substitute nominee who will be designated by the Board of Directors at the annual meeting. Stockholders may withhold authority from voting for one or more nominees by marking the appropriate boxes on the enclosed proxy card. Withheld votes shall be counted separately and shall be used for purposes of calculating whether a quorum is present at the meeting.

Biographical Summaries of Nominees for the Board of Directors

George K. Broady. Mr. Broady, age 79,81, has served as a director of the Company since October 2008. He has been involved in business for more than 40 years, and he is currently active in the direct selling industry and is the principal owner of several privately held companies in the fields of telecommunications and enterprise software. He currently serves as Chairman of the Board of SoloProtect US, LLC, a provider of lone worker safety solutions, and previously served as Chief Executive Officer of that company from 2013 to 2014. He also serves as Chairman of the Board of Management Controls, Inc., a software technology company that delivers contractor management solutions. He previously served as Chairman of the Board of Kings III of America, an emergency communications company, from 2014 until the sale of that company in 2017, and served as Chief Executive Officer of that company prior to 2014. He founded Network Security Corporation, Interactive Technologies Inc. and Ultrak Inc., and brought each of them public on The NASDAQ Stock Market. He was chairman of all three organizations and CEO of both Network Security and Ultrak. All three companies were involved in electronic security, including CCTV and access control. Earlier in his career, Mr. Broady was an investment analyst with both a private investment firm, Campbell Henderson & Co., and with the First National Bank in Dallas. Mr. Broady served twice in the U.S. Army and holds a Bachelor of Science degree from Iowa State University.

Mr. Broady is an experienced investor and businessman who also brings welcomed insight into management, operations, and finances. As a long-time investor in the Company, and incumbent director, Mr. Broady has a deep understanding of the business of the Company and its industry. He is owner of Broady Health Sciences, a leader in dietary supplements invigorating the production of Ca2+ATPase, an enzyme found in every cell of the body, and Soothe, a formula that helps to restore and repair dry skin.

Yiu T. Chan. Mr. Chan, age 51,53, has been a director of the Company since December 2015. Mr. Chan has since July 2016 served as the Corporate Secretary for Shen You Holdings Ltd. (SEHK: 8377) and effective February 2020 Mr. Chan was also appointed an Executive Director of Shen You Holdings Ltd. Shen You Holdings Ltd. is an investment holding company. Mr. Chan also currently servesserved as a self-employed business and tax advisor.advisor from December 2015 to February 2020. Mr. Chan served as a Partner in Grant Thornton’s Tax and Business Advisory group in Guangzhou, China from October 2012 to October 2015, and from 2002 to 2011 served in several senior positions with both Ernst & Young (including Tax Director and Partner from June 2006 to December 2011) and PricewaterhouseCoopers, also located in Guangzhou, China. Mr. Chan served as Director of Investment and Planning from July to September 2012 for Blue Ocean Corporation Limited, which provides business and tax advisory services to foreign companies investing in China and Chinese companies investing overseas.

Mr. Chan has extensive experience in advising companies operating in China, helping to navigate complicated tax and business compliance matters. Mr. Chan holds a bachelor degree in accounting from City University of Hong Kong and is a member of both the Hong Kong Institute of Certified Public Accountants and Association of Chartered Certified Accountants.

Kin Y. Chung. Mr. Chung, age 78,80, has been a director of the Company since February 2015. Mr. Chung founded Bioherb Technology Company, Ltd. in 1988 and served as President of that company from the date of its founding through 2013, at which time he retired. Bioherb Technology Company, Ltd. was a private Hong Kong company that served as an importing company for food and food manufacturing products. Mr. Chung was also a consultant with Blue Ocean Corporation Limited, which provided business consulting services to the Company from June 2009 through June 2010. Mr. Chung has directly provided business consulting services to the Company since July 2010, but ceased doing so prior to his election to the Company’s Board of Directors.

Mr. Chung has been a life-long entrepreneur and businessperson, active in Greater China, by far our most important market. He is extensively experienced in business practices, culture and protocol, particularly those of Hong Kong and China. Mr. Chung also is an expert in importing and exporting consumer products for our core markets.

Randall A. Mason. Mr. Mason, age 59,61, has been a director of the Company since May 2003 and has served as Chairman of the Board of Directors since March 2006. Mr. Mason founded and has served as President and Chief Executive Officer of Marden Rehabilitation Associates, Inc. since 1989. Marden Rehabilitation Associates, Inc. is a private, Eastern U.S. ancillary provider of rehabilitative therapy services and home healthcare. Mr. Mason has a bachelor degree in chemical engineering from the University of Pittsburgh.

Mr. Mason is an experienced businessman with valued insight into management, operations, finances and governance issues. As a long-time member of the Company’s Board of Directors, Mr. Mason understands the business of the Company and its potential risks and pitfalls.opportunities.

Chris T. Sharng. The biographical information for Mr. Sharng, the Company’s President, is set forth above under the caption “Executive Officers.”

As the Company’s President since 2007, and as the Chief Financial Officer prior to that, Mr. Sharng has developed a deep understanding of our business globally. His leadership has been integral to our success in recent years.

The Board of Directors recommends that stockholders vote “FOR” each of the persons nominated by the Board of Directors. Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted FOR the election of the above listed nominees and AGAINST any other nominees.

ITEM TWO

The Dodd-Frank Wall Street ReformAudit Committee has appointed Marcum LLP (“Marcum”) as the Company’s independent registered public accounting firm to perform an integrated audit of its consolidated financial statements for fiscal year ending December 31, 2020 and Consumer Protection Actits internal control over financial reporting as of 2010 (the “Dodd-Frank Act”) providesDecember 31, 2020.

The Audit Committee is directly responsible for the appointment and retention of the Company’s independent registered public accounting firm. Ratification by stockholders of the appointment of Marcum is an advisory matter that is not binding on the Company because it is not required by the Company’s organizational documents or applicable law. Nevertheless, the Audit Committee has determined that requesting ratification by stockholders of its appointment of Marcum as the Company’s independent registered public accounting firm is a matter of good corporate practice. If the Company’s stockholders votedo not ratify the selection, the Audit Committee will reconsider whether or not to approve, on an advisory (non-binding) basis,retain Marcum, but may still determine to retain them. Even if the compensationselection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of the Company and its stockholders.

Audit and Other Professional Fees

During the fiscal years ended December 31, 2019 and 2018, approximate fees billed or accrued to the Company for services provided by Marcum were as follows:

Audit Fees. Fees for the audit of our annual financial statements, including the integrated audit of internal control over financial reporting, and the reviews of our quarterly financial statements totaled $442,000 and $869,000 for 2019 and 2018, respectively.

Audit-Related Fees. No audit-related services were rendered during 2019 or 2018.

Tax Fees. No tax services were rendered during 2019 or 2018.

All Other Fees. No services other than those related to audit fees, audit-related fees or tax fees stated above were rendered during 2019 or 2018.

Pre-approval Policies and Procedures for Audit and Non-Audit Services